Charitable Trust Registration Process:

We have several questions about Trust. If anybody wants to start a Trust, what do they do, how do they start? etc. Here is the solution for all your doubts. A trust is a legal relationship in which the legal title to property is committed to a person or legal entity with a fiduciary duty to hold and use it for another’s advantage. We provide complete information about the “Trust registration process” throughout this article. You get information about Charitable Trusts, what trusts are, how they work, the Charitable Trust Registration process, etc.

What is Trust?

According to Section 3 of the Indian Trust Act of 1882, Trust means that when an obligation is attached to / owned by the property, a person (the settlor) puts the Trust in the hands of another person (Trustee) ( Third-party beneficiary). In other words, a trust is a legal vehicle that allows a third party, a trustee, to operate and manage assets in a trust fund on behalf of a beneficiary. A trust dramatically increases your choices about controlling your assets, whether trying to shield your wealth from taxes or passing it on to your kids.

Charitable Purpose

In the amendment, the expression “Charitable Purpose” Act under section 2 (15) is included in the following:

- Relief of the poor,

- Education,

- Medical Relief

- Advancement of any other object of general public utility.

Types of Trust

Trusts are classified into two categories:

Public Trust

A Public Trust is one whose beneficiaries include the general public or a sizeable portion. Public Trust is further categorized into:

- A public Charitable Trust

- Public Religious Trust

A Public Trust is a Non-Profit Charitable or Non-Governmental Organisation (NGO).

However, charitable and religious trusts fall under the rule of “Charitable and Religious Trusts Act, 1920, Religious Endowment Act, 1863, Charitable Endowments Act, 1890, Bombay Public Trusts Act, 1950” as the law of public trusts in India Are listed.

Note: The Central Act does not apply to public trusts. However, various states have passed their terms and their functions for administration.

Reasons for creating Public Trust?

The main reasons for building public trust are;

- Public trusts are favoured for their simplicity in both registration and administration, making them a popular choice among aspiring trustees..

- A public trust can avail of the exemption in tax from the government under the Income Tax Act.

In addition, the charitable Trust has three requirements:

- Declaration of trust made by the Settler, which is binding on him,

- Separation of certain property by the settler and thereby deprive himself of ownership and

- Description of an item: What will be the property of the beneficiaries?

The property is considered once transferred to a trust.

Further, in case of violation of public trust, either the Advocate General or a suit regarding two or more persons interested in the trust may institute:

1. Removing a Trustee,

2. Appointment of a new trustee,

3. To keep any property in Trustee,

4. Instruct the expelled Trustee to occupy the property of any trust,

5. Directing the audit also.

Read also: Top 10 NGOs in India by NGOFeed 2024 Ranking

Private Trust

A private trust is one whose beneficiaries are individuals or families. Personal trust is further classified into:

- Private Special Trust / Discretionary Trust: In this case, the beneficiary and the share are determined.

- Where either of the two beneficiaries and their share is uncertain.

However, faith can be a mixture of both. Such trusts are called public-cum-private trusts.

Content of a valid Private Trust

Guidelines for creating a private trust are given below.

- The settlor of the property should declare some property set aside for the benefit of the beneficiaries.

- According to the trust deed, a trustee should manage the property to benefit the beneficiaries. A settler may also be a trustee of the same trust.

- There should be a beneficiary or beneficiary who benefits from the property of the colonizer (trust).

- Trust properties are appropriately demarcated.

- Besides, the objects of the trust must be specified.

Reasons for creating a Private Trust?

The private trust route of succession planning is gaining popularity in India as money asset protection grows rapidly. It helps in securing the property while the heirs can benefit from it. Furthermore, it helps to maintain the next generation of wealth rather than dispose of it shortly. Besides, he can enjoy tax benefits or deductions.

- Private trusts help apply the trust’s assets and insolvency protection to retain the trustee’s beneficiary or beneficiary.

- In a private trust declared by will, registration would not be necessary, even if it included an immovable property.

In the case of these trusts, a part of their income is used to promote public welfare, while the other part goes to an individual(s). The part of income going to a person (s) is assessable as private, while the part used to promote public welfare is eligible for tax exemption under section 11. The only condition applicable here is that the trust must have been created before 1-4-1962, before the Income-tax Act of 1961. Public-cum-private trusts created on or after this date are not eligible for this exemption under Section 11.

This article is to guide you in registering a charitable trust. It is an attempt to remove all doubts, questions and confusion related to it. Before registering for the Charitable Trust Registration, you should know the basic concept behind thTrTrust and some related terms.

Role of Trustee

Let’s have a look at the critical role of the Trustee:

Author of Trust

A person who repeats or declares the trust is called the “author of the trust”. As per the Indian Trust Act, any person or minor permitted by the contract can trust the principal civil court of the original jurisdiction. But in each case, according to the law for the circumstances and the time limit on which the trusted author can dispose of the trust property.

Trustee

A person who accepts a faith revoked or declared by the author/settler is called a “trustee”.

According to the Indian Trust Act, the following can be a trustee:

- A person is capable of holding property, but where the trust involves the exercise of discretion, it cannot proceed until it is competent to contract.

- The trust is not obliged to accept.

- A sign of acceptance with reasonable certainty by any words or acts of the trustee.

- Instead of accepting a trust, the expected trustee can reject it within a reasonable time. Such rejection prevents the trust property from being vested therein.

- Disclaimer by two or more co-trustees to reject the trust property in one or the other and form the sole trustee or trustee from the date of creating the trust.

- A trustee has to fulfil the trust’s purpose while following the Settler’s instructions at the time of its creation, amended with the consent of all other trustees.

- A trustee has the right to work, reimburse expenses, settle accounts, decree, etc. However, a trustee cannot relinquish after approval or use the trust property for his benefit. He cannot delegate or work in private.

Beneficiaries

Those who benefit from the confidence accepted by the author/settler and Trustee are called “beneficiaries”.

According to the Indian Trust Act, any person who is a beneficiary can keep the property. Beneficiaries have the right to rent, benefits, specific execution, seeking copies of the trust’s instruments, forcing them to do any work, etc. A proposed beneficiary may relinquish their interest to the Trustee subject to the Trustee with a claim inconsistent with the disclaimer or notice of the trust.

Trust property

The subject of Trust is called “trust property” or “trust money”—an Instrument of Trust – “Instrument of Trust” The instrument by which trust is declared.

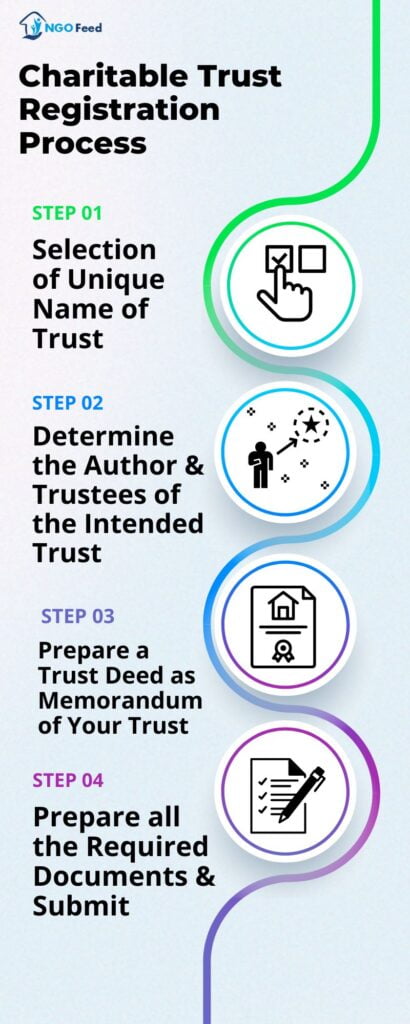

Charitable Trust Registration Process (Flow Chart)

Here, we provide information about the Trust Registration Charitable Trust Registration Process; follow these easy steps to start a Trust. Let’s see.

How do you start the Charitable Trust Registration Process?

1. Before registering your Trust, you must make the following decisions:

- Name of the Trust

- Address of the Trust

- Objects of the Trust (charitable or Religious Trust)

- One Settler of the Trust

- Two Trustees of the Trust

- Trust property is movable or immovable property (To save on stamp duty, a small amount of cash/check is usually given to be the initial property of the trust).

2. Prepare a trust deed on stamp paper of expected value (8% of the value of the trust’s property in Delhi. This rate varies from state to state)

3. Registration requirement of the trust deed with the local registrar under the Indian Trust Act, 1882:

- Trust deed on stamp paper of expected value (as stated at point 2 above)

- A passport-size photograph and a copy of the settler’s identity

- One passport-size photograph and a copy of proof of identity of each trustee.

- A passport-size photograph and a copy of the proof of identity of each of the two witnesses.

- Signature of settler on all pages of a Trust Deed.

- Witness by two persons on the trust deed.

4. Go to the local registrar and submit a trust deed and a photocopy for registration. The photocopy of the deed must also contain the signature of the settler on all pages. At registration, the Settler and two witnesses must be present in person, and their identity must be proven in the original.

5. The Registrar retains the photocopy and returns the original Registered copy of the Trust Deed.

Trust deed proves the legal status and is mandatory if a property is involved, especially land and building, to provide “A Prima Facie” evidence. It is an essential instrument of Trust. It contains a declaration of the aims, objectives and management modes (of the trust).

The appointment and removal procedures are outlined in the trust deed to eliminate any opportunity for future discrepancy. If there is a change of trustees or their number or registered address for the trustor’s aims and objectives, a new trust deed should be prepared after this one must be registered at the Registrar’s Office. If not prepared properly, the trust deed becomes useless and is akin to working without registration. Without a well-crafted fiduciary trust, there is a greater likelihood of future confusion, issues and disputes. Your Trust will face many problems in purchasing projects or raising funds.

Some people mistake trusts for existing trusts, which is a big mess because every trust is different, and the memorandum should be prepared explicitly targeting their particular needs. Thus, it is advisable to hire a consultant, as they are experienced in formulating trusts that meet specific needs. Their main function is to prepare a trust deed.

Documents Required:-

In this section, you will be able to get complete detailed information about the documents required for trust registration in India.

- Charitable Trusts are registered under the Public Trust Act of 1882.

- Needs a minimum of 2 persons above 18 years old just in case} of female and 19 years old in case of males with a sound mind and with any or no educational qualifications.

- Government and semi-government employees, too, are eligible to be Trustees of trust. They create no profit, salary, or personal interest for themselves through the public trust and offer selfless social services to the Trust.

- Aadhar and PAN Cards (Original and their Self Attested Copies) are required together with Water/ Electricity bills within their name or in the owner’s name of the property and the Permission/Consent letter the owner to open the Registered Office of Trust(NGO).

- A rent Agreement is also required if the property is on rent, with two witnesses, one of which is to be a Registered Advocate, together with two passport-sized photos.

- The trust deed is to be signed and submitted in the sub-registrar office under the Revenue Department of the concerned district court of the respective area/district.

NOTE: Legal document done by an experienced or knowledgeable Advocate to avoid future conflicts.

What are the Benefits of Trust Registration?

Here in this section, we provide information about critical topics like the Benefits of Charitable Trust Registration. Let’s have a look one by one.

- To Include in Charitable Activities

- Registered Trust Avails Tax Exemptions

- Gives Benefits To Poor People

- Compliance With Law

- Preservation Of Family Wealth

- Avoid Probate Court

- Immigration Of Family

- Forced Heirship

- Tax Mitigation & Managing Assets

Frequently Asked Questions (FAQs)

What are the Documents Required During the Charitable Trust Registration process in India?

> Charitable trusts are registered as public trusts under the Public Trust Act of 1882.

Needs a minimum of 2 persons above 18 years old just in case} of female and 19 years old in case of males with a sound mind and with any or no educational qualifications.

> Government and semi-government employees, too, are eligible to be Trustees of trust. They create no profit, salary or personal interest for themselves through the public trust and offer selfless social services to the Trust.

> Aadhar and PAN Card (Original and their Self Attested Copies) are required together with Water/ Electricity bills within their name or in the owner’s name of the property together with the Permission/Consent letter of the owner to open the Registered Office of Trust (NGO).

Read the above article to learn more about the documents required during the Charitable Trust Registration process.

What are the different types of Trust?

There are two types of Trust

1- Private Trust

2- Public Trust

What is the Difference between Trustee and Trustor?

The trustor is the person who creates the trust, whereas the person responsible for accomplishing the trust for the beneficiary is known as a Trustee.

How do you open a charitable trust in India?

Before registering your trust, you must make the following decisions:

> Name of the Trust

> Address of the Trust

> Objects of the Trust (charitable or Religious Trust)

> One Settler of the Trust

> Two Trustees of the Trust

> Trust property movable or immovable property (To save on stamp duty, a small amount of cash/check is usually given to be the initial property of the trust).

Read the above article carefully to check the complete process of starting a trust or filling out the Charitable Trust Registration form.

Does a charitable trust need to be registered?

All Charitable Incorporated Organisations (CIOs) must register with the Charity Commission, regardless of their annual income. CIOs do not formally exist as charities until registered for the charitable trust registration.

What is the difference between trust and charitable trust?

Charitable Purpose A charitable purpose improves, benefits or uplifts humankind mentally, morally, or physically. The requirements of intention, trustee, and res in a charitable trust are the same as those in a private trust. As a general rule, a charitable trust may last forever, unlike a private trust.

Read also:

| Section 8 Company Registration | CSR Registration |

| FCRA Registration | 12A and 80G Registration for NGO |

| How to Start an NGO | Society Registration Process |

| NGO Darpan Registration | – |

Can a settler be one of those trustees in the trust?? Is it mandatory of having atleast 2 trustees??? I want to run the trust only with a settler and a chairperson…. Is it possible sir/mam?? Awaiting your reply….

Yes, it is possible you can run trust in 2 members.

Yes. The Settlor or Author is usually a Trustee too. In rare scenarios when the actual Settlor is not able to be physically present in the court then anyone on his behalf can be a settlor only in case of (attaching movable property to the trust). That person will only be settlor and not Trustee & later can resign as Trustee as per mutual arrangements. In General, if there is mutual agreement between other Trustee(s), the Settlor/Author is Trustee too.

Atleast 2 persons are required as Trustees to establish a Charitable Trust (NGO)

Thank you

For your valuable comment.

Hi, How do I know as a settler that my trust is a charitable trust or otherwise?

ஆலோசனை தேவைப்படுகிறது அறக்கட்டளை தொடங்குவதற்கு

You can check the above detail for trust registration.

Hello Sneha,

Thank you for the valuable comment.

Excellent and nice explanation… very informative… keep it up… all the best

I am disable in ortho. I registered trust for intellectual challenged. I am in vellore district. To whom i want to inform and start the same. Please help to us. Thanks.

Charitable Trusts are registered under Public Trusts under Charitable Trust Act, 1882. You need atleast 2 persons above 18 years of age in case of female and 19 years of age in case of males with sound mind and with any or no educational qualifications. Government, Semi Government employees too are eligible to be Trustee of a Charitable Trust with a condition that they make no profit, salary or personal interest for themselves through the Charitable Trust and offer selfless social services to the Trust. Aadhar, PAN Card (Original and their Self Attested Copies) are required along with Water/ Electricity bill in their name or in owner’s name of the property along with Permission/Consent letter of owner to open Registered Office of Trust(NGO). Rent Agreement too required if property is on rent. 2 witnesses one of which to be Registered Advocate alongwith 2 passport sized photos. Trust Deed to be signed and submitted in Sub-Registrar office under Revenue Department of the concerned District Court of the respective area/district. It’s advisable that you get your Trust Deed done by an experienced or knowledgeable Advocate to avoid future conflicts.

Hello Sneha.

Great, thanks for sharing this information.

Keep visiting

Hi,

I want to start a trust in the nutrition arena.

9810360863

I would like to establish a trust in memory of my father. Major activities of it will be health, education and economic upliftment of the needy group. I want to keep the ownership within my family. Looking forward for your advise.

Yes, and you can complete the entire process of trust registration in the above article.

Is Trust registration certificate necessary?or Trust deed is enough at delhi

Yes the trust deed is enough because the most important document required for Trust registration is ‘Trust Deed.

Sir a m a man from Tanzania seeking to become your food distributor to poor families in TANZANIA

Dear,

If you wanted to help poor families by providing great food, then do it.

NGO job

I want to start new trust can you please assist your guidance.

Hello Naveen,

If you want to start a trust then there are just six steps to setting up a trust:

Decide how you want to set up the trust.

Create a trust document.

Sign and notarize the agreement.

Set up a trust bank account.

Transfer assets into the trust.

For other assets, designate the trust as a beneficiary.

How to register a trust

You can check the complete information in the above post.

I want to start new trust. can you help for this

Please carefully read the article above for information on how to complete your registration.

We are interested in starting a private trust that includes socio-cultural and religious activities. Is there someone we speak with in detail?

Thank you!

Hey there!

You can check the complete registration process in the above post.

Sir / Madam, who is the settlor? 2. I want to open a library, provide books and internet facility to the poor and needy students. to start with my village in our ancestral house. 3. Please guide me – (a) can start a charity trust or Society Act

1: Settlor means: A person who makes a settlement of the property and a person who creates a trust by conveying property to a trustee; trustor.

To start a trust or go through the above article carefully.

We are going to commence old age home,in Haryana

That’s great; All the Best.

Hi I want new trust

You can check the complete trust registration process for starting a new trust.

Hi team, can i get the application for the registration of Telangana?

Yes, you can register for trust; check the complete registration process in the above articles.

The question answer section is very much practical to help in little more detail understanding. Thanks

Thank you for your feedback. We will update it soon.

ತುಂಬಾ ಅದ್ಭುತವಾದ ಮಾಹಿತಿ sir,,

ನಾನು ಸಹ ತೀರಿ ಹೋದ ನನ್ನ ಪತಿಯ ಹೆಸರಿನಲ್ಲಿ ಒಂದು ಟ್ರಸ್ಟ್ ಮಾಡಲು ಇಚ್ಚಿಸಿದ್ದೇನೆ,, ನನಗೆ ಮಾಹಿತಿ ನೀಡುವುದರ ಮೂಲಕ ಸಹಾಯ ಮಾಡಿ,🙏

Could you ask your query in English?

Thank you

శ్రీ గురుభ్యోనమః మాతాపిత్రృబ్యోనమః నేను సురభి గోసంరక్షణ శాల సేవ సమితి లా రిజిస్ట్రేషన్ చేయించుకోవాలి అనిపించింది నాకు సహకరించేందుకు పూర్తి వివరాలు తెలియాల్సి ఉంది

Kindly elaborate your query in English.

ఒక ట్రస్టు ని ఎలా ముందుకు కొనసాగించాలి అనే అంశం పై అవగాహనా వ్రాతపూర్వకంగా కల్పించగలరు అలాగే వాటి నియమ నిభందనలు ఏమిటి అనే దానిపై అవగాహనా కల్పించాలని కోరుకుంటూ మీ విశ్వాసి విధేయుడు

Kindly elaborate your query in English.

Our goal is simple: to grant every animal the freedom to live without suffering. Join us in providing care, advocacy, and support to ensure they thrive in a world free from neglect and cruelty. Your support transforms their lives, turning their dreams of a brighter future into reality.

That’s Great!

We can help you. NGOFeed offers you the opportunity to promote your NGO’s mission, share inspiring success stories, and gain global visibility. You can showcase your stories, inspiring journeys, impacts, and challenges, and list your organization on our platform by using this link: https://app.ngofeed.com/.