The purpose of FCRA, 2010 has been enacted by the Parliament to consolidate the law to control the acceptance and utilization of foreign contributions or foreign hospitality by specific individuals or associations or companies and to ban the acceptance and utilization of foreign contributions or foreign hospitality for any activities detrimental to national interest and matters connected in addition to that or incidental to it. In other words, Charitable Trusts, Societies, and Section 8 Companies that receive foreign contributions or donations from foreign sources are required to get registration under Section 6(1) of the Foreign Contribution Regulation Act, 2010. Such a registration under the Foreign Contribution Regulation Act 2010 is named an FCRA registration.

This article provides detailed information about FCRA Registration Procedure, step-by-step guidance, the document required, eligibility criteria, FCRA renewal procedure, prior permission, Administrative Expenses and much more.

Latest Update: Indian Government extends the validity of NGOs FCRA registration Certificate till June 30

Table of Contents

FCRA Registration and Prior Permission

Now the questions are started How does a person obtain permission to accept foreign contributions? So there are two modes of obtaining permission to accept foreign contributions, according to FCRA, 2010:

- Registration: Registration is the official process by which a non-governmental organization (NGO) is legally recognized by the appropriate authority (such as the Registrar of Societies, Registrar of Companies, or Charity Commissioner), enabling it to operate lawfully, receive grants or donations, and carry out its social or charitable activities.

- Prior Permission: Prior Permission refers to the approval granted by the Ministry of Home Affairs (MHA), Government of India, under the Foreign Contribution Regulation Act (FCRA), allowing an NGO to receive a specific amount of foreign contribution from a particular foreign donor for a defined project or purpose.

Eligibility Criteria of FCRA Registration

This section will provide detailed information about FCRA Registration ELigibility criteria for FCRA registration or Prior Permission. The world is more focused on social and environmental causes in the present scenario. Apart from their common profit-making objective, businesses are actively involved in activities that promote social, economic, cultural, and ecological growth and prosperity. So, check the details one by one.

Eligibility criteria for grant of registration:

- For the grant of registration under FCRA, 2010, the Association should be registered under an existing statute just like the Societies Registration Act, 1860 or the Indian Trusts Act, 1882 or section 25 of the Companies Act, 1956 (Now Section8 of the Companies Act, 2013) etc.

- Normally be breathing for at least three years and has undertaken reasonable activity in its chosen field to benefit the society where the foreign contribution is proposed. The applicant NGO/association are liberal in choosing its expenditure items (excluding the executive expenditure as defined in Rule 5 of FCRR, 2011) to become eligible for the minimum threshold of Rs. 15.00 lac spent during the last three years.

- Suppose the Association wants to include its capital investment in assets like land, building, other permanent structures, vehicles, equipment etc. In that case, the Chief Functionary shall give an undertaking that these assets shall be utilized just for the FCRA activities and that they won’t be diverted for the other purpose till FCRA registration of the NGO holds.

Eligibility Criteria for grant of prior permission:

An organization in the formative stage is not eligible for a registration certificate. Such an organization may apply for a grant of prior permission under FCRA, 2010. Prior permission is granted to receive a specific amount from specific donors/donors for carrying out specific activities/projects. For this purpose, the Association should meet the following criteria:

- It should be registered under an existing statute just as the Societies Registration Act, of 1860 or the Indian Trusts Act, of 1882 or section 25 of the businesses Act, of 1956 etc.

- Submit a selected commitment letter from the donor indicating the quantity of foreign contribution and, therefore the purpose that it’s proposed to be given; and

- For Indian recipient organizations and foreign donor organizations having common members, FCRA Prior Permission shall be granted to the Indian recipient organizations subject to its satisfying the following:

- The Chief Functionary of the recipient Indian organization mustn’t be an element of

- the donor organization.

- At least 75% of the office-bearers/ members of the establishment of the Indian recipient organization mustn’t be members/employees of the foreign donor organization.

- In the case of a foreign donor organization being one person/individual, that person mustn’t be the Chief Functionary or office bearer of the recipient Indian organization.

- In the case of one foreign donor, a minimum of 75% office bearers/members of the administration of the recipient organization mustn’t be the members of the family and shut relatives of the donor.

Read also: Know the NGOFeed 2024 Ranking of Top 10 NGOs in India

FCRA Online Registration Form

The online application form FC-3 (A) for registration / FC-3 (B) prior permission has been designed in an easy to fill format. The applicant will find instructions on each web page of the online form while filling out the application. The procedure for online FCRA registration is explained here.

How to Fill FCRA Registration Procedure 2024 Step-by-Step Guidance

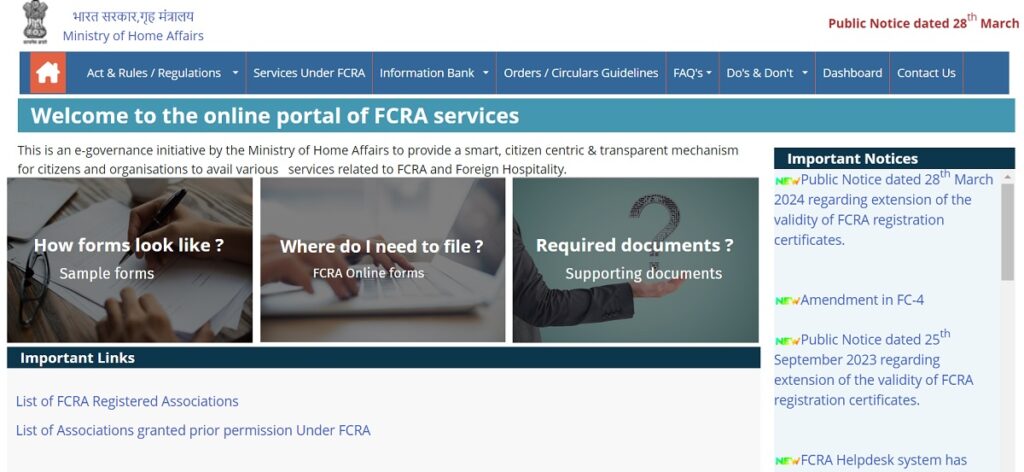

- Step 1: Go to the Official Website: Visit the Ministry of home affairs website (http://fcraonline.nic.in).

- Step 2: FCRA Online Forms: After clicking on FCRA online forms link from the previous screen

- Step 3: FCRA Online Application for FCRA Registration: After clicking on the FC-3 Application for FCRA Registration link, click the Click to apply online button.

- Step 4: Login & Signup: After Clicking on Application for FCRA (FC3), Login & signup for a new account, and note down your user-id.

- Step 5 Applicant will log in with their user id, and password generated: Applicant will log in with their user id and password generated, fill in all the required details like FCRA registration association detail, FCRA registration executive committee details, EC details and other details, bank and other details

- Step 6: Form Filling and Document Upload: After filling in all the required details then, upload all the required documents and then submit the form.

- Step 7 Form Payment: Submit the online form payment and submit form.

NOTE: To see the detailed explanation of the FCRA online registration procedure in PDF step-by-step, Click Here

Document Required for FCRA Registration 2024

In this section, we are providing you with all the FCRA registration documents required; the applicant should be ready with scanned copies of the following documents before applying online:

Registration

- jpg file of the signature of the chief functionary (size:50kb)

- self-certified copy of registration certificate/Trust deed etc., of the Association (size: 1MB)

- Self-certified copy of relevant pages of Memorandum of Association/ Article of Association showing the aim and objects of the Association. (size: 5MB)

- Activity Report indicating details of activities during the last three years (size: 3MB)

- Copies of relevant audited statements of accounts for the past three years (Assets and Liabilities, Receipt and Payment, Income and Expenditure) reflecting expenditure incurred on aims and objects of the Association and administrative expenditure. (size: 5MB)

- The FCRA registration fees of Rs. 10,000/- is to be paid online through a payment gateway.

Prior Permission

- Jpg file of signature of the chief functionary(size:50kb)

- Sef-certified copy of registration certificate/Trust deed etc., of the Association (size: 1MB)

- Duly signed Commitment Letter from Donor. (size: 5MB)

- If functioning as editor, owner, printer or publisher of a publication registered under the Press and Registration of Books Act, 1867, a certificate from the Registrar of Newspapers for India that the publication is not a newspaper in terms of section 1(1) of the said Act.

- A fee of Rs. 5000/- is to be paid online through a payment gateway.

- Project Report for which FC will be received. (size: 3 MB)

FCRA Renewal Registration Process

In this section, we provide detailed information about the FCRA registration renewal procedure in step-by-step guidance. Let’s have a look.

Required documents for uploading in Renewal of Registration (FC-3C)

These are all the required documents for uploading in the renewal of registration (FC-3C):

- Registration Certificate of Association with the maximum size limit of PDF document is 1 MB.

- Memorandum of Association/Trust Deed with the maximum size limit of PDF document is 5 MB.

- FCRA Registration Certificate of Association issued by MHA with the maximum size limit of PDF document is 1 MB.

Please also be ready with the image of the signature of the Chief Functionary and the image of the Seal of the Association, which are saved in JPG/JPEG format and available for uploading:

Instruction for Images

- The image Dimension of the Signature should be 140(Width) * 60(Height) Pixel only.

- Ensure that the size of the scanned signature image is not more than 50 KB.

- Image Dimension of the Seal of Association should be 140(Width) * 60(Height) Pixel only.

- Ensure that the size of the scanned image of the Seal of Association is not more than 100 KB.

Administrative Expenses

Rule 5 of FCRR, 2011 defines that administrative expenses include the following:

- Salaries, wages, travel expenses or any remuneration realised by the Members of the Executive Committee or Governing Council of the person;

- All expenses towards hiring of personnel for management of the activities of the person and salaries, wages, or any kind of remuneration paid, including the cost of travel, to such personnel;

- All expenses related to consumables like electricity and water charges, telephone charges, postal charges, repairs to premise(s) from where the organisation or Association is functioning, stationery and printing charges, transport and travel charges by the Members of the Executive Committee or Governing Council and expenditure on office equipment;

- Cost of accounting for and administering funds;

- Expenses towards running and maintenance of vehicles;

- Cost of writing and filing reports;

- Legal and professional charges; and

- Rent of premises, repairs to premises and expenses on other utilities.

Provided that the expenditure incurred on salaries or remuneration of personnel engaged in training or for collection or analysis of field data of an association primarily engaged in research or activity shall not be counted towards administrative expenses: Provided further that the costs incurred directly in furtherance of the stated objectives of the welfare-oriented organization shall be excluded from the administrative costs such as salaries to doctors of the hospital, wages to teachers of school etc.

Offences and Penalties and Compounding of certain offences

Under section 41, the government has issued a gazette notification dated 5.06.2018 and 27.07.2018, which is highlighted below:

| Offence | Amount of Penalty |

| The offence is punishable under section 35 for accepting any hospitality in contravention of section 6 of the Act. | Rs. 10,000/- |

| The offence is punishable under section 37 for transferring any foreign contribution to any other person in contravention of section 7 of the Act or any rule made thereunder. | Rs. 1, 00,000/- or 10% of such transferred foreign contribution, whichever is higher. |

| The offence is punishable under section 37 for defraying of foreign beyond fifty per cent of the contribution received for administrative expenses in contravention of section 8 of the Act. | Rs. 1, 00,000/- or 5% of such foreign contribution so defrayed beyond the permissible limit, whichever is higher. |

| The offence is punishable under section 35 for accepting a foreign contribution in contravention of section 11 of the Act. | Rs. 1, 00,000/- or 10% of the foreign contribution, received, whichever is higher; |

| Offences punishable under section 37 read with section 17 of the Act for – (a) receiving foreign contribution in account in his application for grant of a certificate; | Rs. 1, 00,000/- or 5% of the foreign contribution received in such account, whichever is higher; |

| (b) non-reporting the prescribed source and manner of such remittance by banks and authorized persons. | Rs. 1, 00,000/- or 3% of the foreign contribution received or deposited in such account, whichever is higher; |

| (c) receiving & depositing any fund other than foreign contribution in the account or accounts opened for receiving the foreign contribution or utilizing the foreign contribution. | Rs. 1, 00,000/- or 2% of such deposit, whichever is higher; |

| An offence punishable under section 37 for non-furnishing of intimation of the amount of each foreign contribution received and the source from which and in the manner in which such foreign contribution is received as required under section 18 of the Act. | Rs. 1, 00,000/- or 5% of the foreign contribution received during the period of non-submission, whichever is higher. |

| The offence is punishable under section 37 for not maintaining the account and records of foreign contributions received and its utilization on required section 19 of the Act. | Rs. 1, 00,000/- or 5% of the foreign contribution during the relevant period of non-maintenance of accounts, whichever is higher. |

Frequently Asked Questions (FAQs)

Q. Who can receive foreign contributions?

A. Any” Perso” can receive foreign contribution subject to the following conditions:-

a) It must have a definite cultural, economic, educational, religious or social

programme.

b) It must obtain the FCRA registration/prior permission from the Central Government

c) It must not be prohibited under Section 3 of FCRA, 2010

Q. Can a private limited company or a partnership firm get registration or prior permission under FCRA, 2010?

A. Yes, a private limited company too may seek prior permission/registration for

receiving foreign funds in case they wish to do some helpful work/beneficial to society.

Q. Whether an individual or a Hindu Undivided Family (HUF) can be given registration or prior permission to accept a foreign contribution in terms of section 11 of FCRA, 2010.

A. Yes. The definition of the Perso” under section 2(1)(m) in the Foreign Contribution

(Regulation) Act,2010 includes any individual and a Hindu Undivided Family” among

others. An individual or a HUF is also eligible to apply for a registration certificate or prior permission to accept foreign contributions.

Q. How to apply for a grant of registration/prior permission?

A. Application for grant of registration or prior permission is to be submitted online in

form FC-3 (A) or FC-3 (B) at the website- https://fcraonline.nic.in/home/index.aspx

Q. How to fill online form for applying for a grant of registration / prior permission?

A. The online application form FC-3 (A) for registration / FC-3 (B) prior permission has been designed in an easy-to-fill format. The applicant will find instructions on each web page of the online form while filling out the application.

Q.4 How to rectify an error in the application for registration or PP that has already been submitted online?

A. No rectification of error is allowed after the application has been finally submitted

online. In case of an error, please get in touch with the Support Centre/ Help Desk of the FCRA.

Q. Are Aadhar Numbers and Darpan ID mandatory for all members and NGOs, respectively?

A. For all FCRA services provided through the online portal, Aadhar Number & Darpan ID

are mandatory now.

Q. What are the amount fee for the grant of registration and prior permission and renewal?

A. For registration, the Association is required to pay a fee of Rs. 10,000/- and for prior

permission, the fee is Rs. 5,000/- and for renewal, the fee is Rs 5000/- only

Q. Is it mandatory for existing NGOs also to open”FCRA an account” in SBI, Sansad marg, Main branch, New Delhi & How?

A. FCRA registered NGO shall have to open ”’FCRA account” in SBI, Sansad marg, Main branch, New Delhi to receive foreign contributions. Organisations located anywhere in India can open and maintain designated FCRA accounts at SBI, Main branch, New Delhi, without visiting physically New Delhi. In this regard, a detailed SOP of the State Bank of India is available in the public domain on the portal of SBI & FCRA.

Read also:

| Trust Registration Procedure | How to Start Society? |

| How to Start an NGO | CSR Registration for NGO |

| 12A and 80G Registration for NGO | NGO Darpan Registration Procedure, |